Note: This report covers the period between January 1st and March 31st. Approximations are made if a transaction spans multiple quarters. Values are USD unless specified otherwise.

Table of Contents

A Message from the Streamr Governance Council

The first quarter of 2025 marked a pivotal transition for the project—from focusing on building deep tech infrastructure to creating applications that fully leverage it.

With the foundational work of delivering the decentralized network largely complete, we’re now able to move faster in developing groundbreaking products. The first of which is StreamrTV—a broadcasting app that leverages the decentralized Streamr Network. At the same time, we’ve maintained solid momentum on the protocol layer and strengthened our industry ties—particularly across the defence, video streaming, and DePIN sectors.

In Q1, the Web3 and cryptocurrency markets were influenced by macroeconomic shifts, regulatory developments, and evolving investor sentiment which has validated our application focus shift.

Key achievements

- One-to-many media broadcasts on StreamrTV exclusively using the Streamr Network and protocol.

- Nearing completion of the StreamrTV 1.0 mobile compatible web app.

- Completed a series of large-scale tests to measure and verify the Streamr 1.0 network’s latency and scalability characteristics, especially to quantify the improvements obtained via locality awareness.

- Started development on the Streamr Node Autostaker for Node Operators.

- Improved the Streamr Network stream “Time To Data”, especially relevant for consumer applications and their requirement for near real-time load times.

- Progress has been made toward enabling quantum-resistant data streaming. The first stage—now nearing completion—involves replacing the current RSA-based key exchange with a quantum-resistant algorithm for secure communication between stream participants.

- Started a prototyping project around decentralized, secure communication in the defense industry, to be completed in Q2.

- Deployed the DATA token on to the IoTeX chain. It’s awaiting bridge approval.

- Built an MVP of a decentralized AI agent powered crypto news video channel.

Project financials

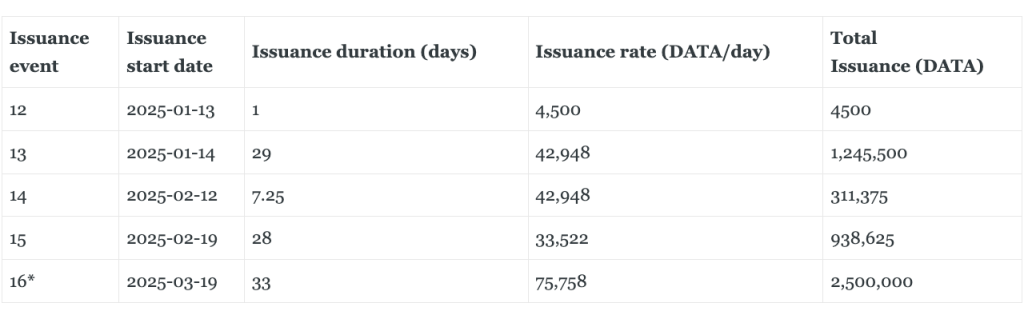

- Approximately 2.5M DATA tokens were minted and distributed to community Node Operators.

- USD $457,702 was raised from the sale of 15,557,725 minted DATA tokens at an average price of $0.029 for project development and growth.

- At the end of Q1/2025 the project strategic reserve was approximately $801,000 USD, an increase of approximately 12% from the last quarter. A decision was made midway through the Q1 to not increase the strategic reserve further, given the difficult market situation.

- 0.236M DATA tokens were generated in network protocol fees this quarter.

Funding packages

Status of approved project funding packages:

- SIP-9 (11/2022): 100% used, 0 DATA remaining

- SIP-22 (10/2024): 17.8% used, 82,176,025.1 DATA remaining

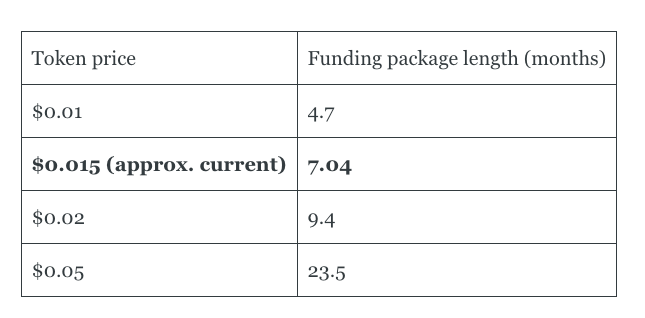

Runway months = Market Price (0.015) * Tokens Remaining / Average monthly burn (175k)

= 7.04 months

Funding package projections

Below are projections for how many months the current funding package will last at different token price levels, assuming the current average monthly burn rate of $175k.

On top of the above, the project strategic reserve further extends the project runway by approximately 4 to 5 months, based on the current average monthly spending rate.

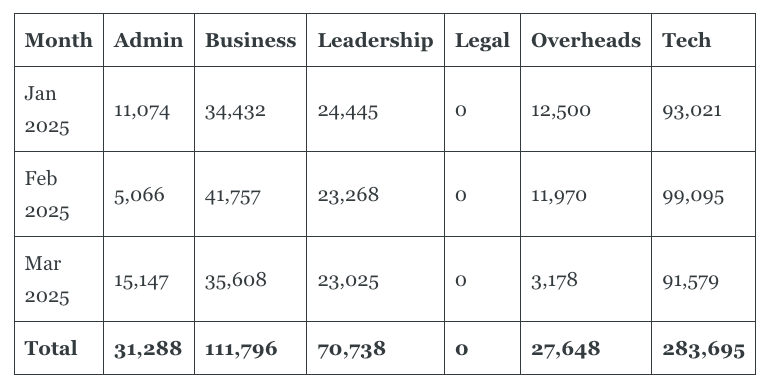

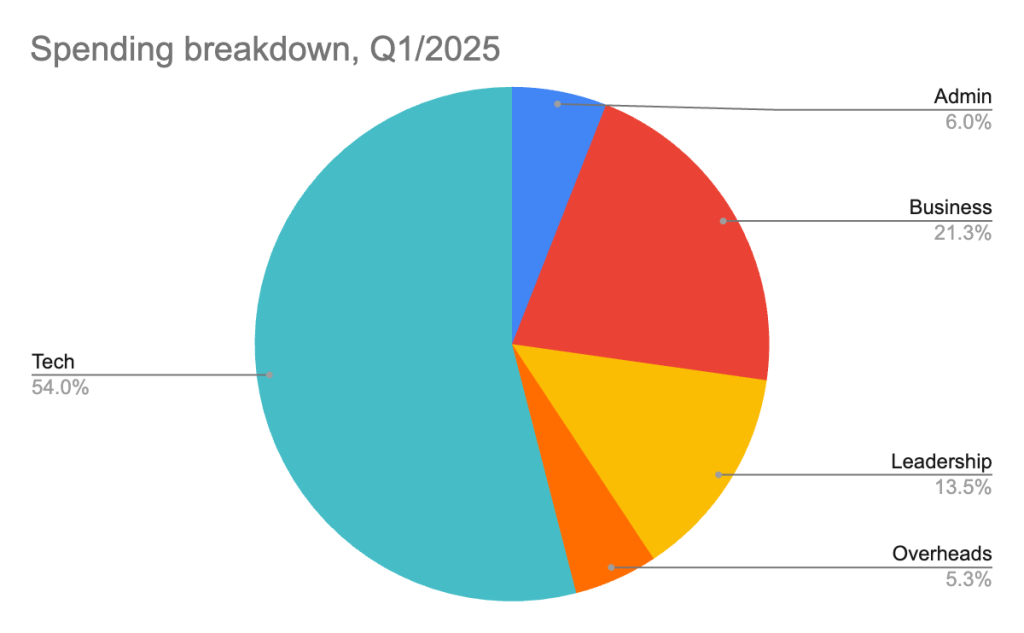

Project expenses

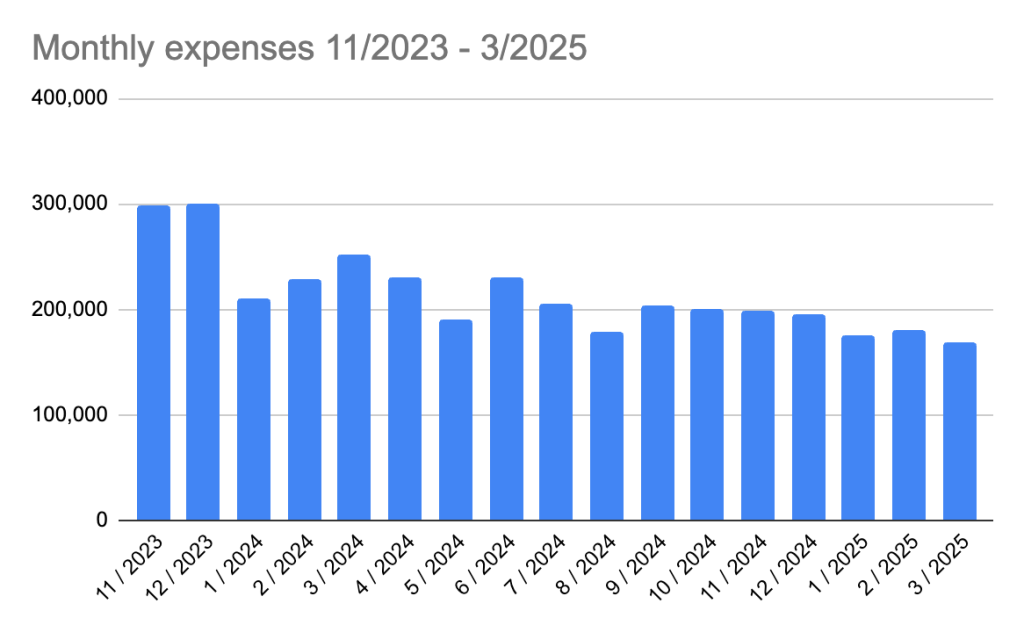

The team size remained more or less the same size during Q1, leading to predictable expenses across the board, coming slightly under the spend in Q4, 2024. Monthly variations are typically due to lump sum annual invoicing.

As we move forward, we’re actively reviewing all expenditure with an eye toward reducing costs. We’re identifying areas where efficiencies can be made without compromising key operations, and will prioritize cuts that have the least impact on our core activities.

Broader macroeconomic conditions have also added pressure. The weakening of the USD against the CHF and EUR will lead to higher effective costs for the project, as a significant portion of our expenses are denominated in these stronger currencies.

Spending is categorised under the following six categories:

Admin: HR, accounting, bookkeeping, offices, utilities, financial services.

Business: Bizdev & marketing team salaries, ad and campaign expenses, events.

Leadership: Project leadership salaries.

Legal: Legal and compliance fees.

Overheads: Insurance, mandatory pension payments, taxes.

Tech: Developer salaries, product UX/UI designers, software licenses and cloud services.

Total project expenses in Q1 2025: $525’164 USD

Locked/staked supply

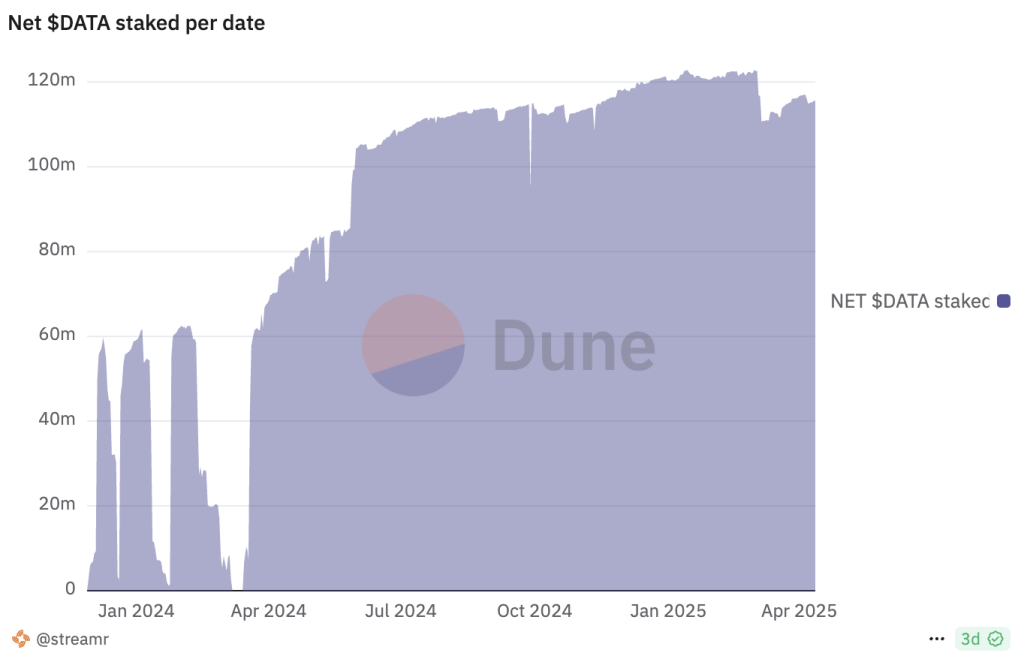

The amount of locked tokens has declined from approximately 120M DATA to 116M representing 3.4% decline in the amount of tokens locked in Stream Sponsorships from the start of the quarter to the end of the quarter.

Node Operators

Approximately 2.52M DATA tokens have been issued (approved in SIP-14) to node operators this quarter through Streamr Sponsorships to help secure the streaming network.

Active node operators were 207 at the start of the quarter, dropping to 187 at the end of the quarter—a 10% drop.

DATA Ecosystem fund

The Data Fund offers grants to projects and individuals to build with Streamr and contribute to its goals. Fund balance: 11,226,620 DATA.

There were no applications worthy of grant funding on the DATA Ecosystem fund this quarter. Low engagement with the fund will be addressed in Q2, possibly offering bounty rewards from the fund for useful actions, especially in relation to StreamrTV.

Governance updates

No new Streamr Improvement Proposals (SIPs) were proposed, focusing instead on implementing prior decisions.

Risks and Challenges

Adoption

Streamr has been navigating the broader downturn in sentiment across the Web3 ecosystem, which has significantly impacted the willingness and ability of many Web3 projects to allocate resources toward decentralization initiatives. This industry-wide caution has translated into slower decision-making, tighter budgets, and reduced appetite for experimentation—factors that directly influence adoption and collaboration opportunities for projects like Streamr.

In this respect, our strategic shift towards building at the application layer is well validated. Our first app release is already showing a radical change in how we communicate and utilize the Streamr Network. While it’s still in private testing, early results indicate it could be a game changer for driving adoption of the Streamr Network in terms of data throughput and utilization of the incentivized operator layer. Most importantly, the Streamr Project will remove its dependence on the Web3 ecosystem as the main driving force for protocol adoption.

Technical challenges

In the previous quarter, it was observed that a significant portion of the Network had been slow to update their node and SDK versions, which may have contributed to reduced network performance. More recently, Node Operators were required to upgrade to the latest version of the Streamr node software in order to participate in stream Sponsorships. This update has led to improved network performance, and the project has since published a “Responsibilities and Expectations” document for Node Operators.

Security vulnerabilities or incidents

There have been no consequential security incidents.

Legal or regulatory updates

There have been no consequential legal or regulatory incidences.

If you have any questions about this transparency report, feel free to ask in the governance channel on the Streamr Discord.