At EDCON Paris 2017, we met Mona El Isa and were struck by the ingenuity of the Melonport vision: a platform for asset management on the blockchain which allows anyone to set up well-designed, trustworthy funds and portfolios of digital investment instruments. Quite revolutionary!

Saying so is by no means a simple platitude. As mentioned in a previous blog post, we Streamr principals are all finance professionals from the “old world”: One algorithmic trader, one trading platform architect, and one with a distinguished background in institutional and quantitative asset management.

Armed with a certain understanding of the terrain, we could immediately see the usefulness of the Melon project, and also how Streamr could complement it. In this blog post, we outline some early ideas that spring to mind.

Data, data, data…

As described in our whitepaper draft, Streamr’s DATAcoin vision is one of a decentralized data backbone for Ðapps. The Streamr stack includes a data transport layer based on a peer-to-peer network, a data market above, and a processing engine and usability layer as the cherry on top. Melon funds will thrive on high-quality, professional financial data, which we have precisely the means to provide. In concrete terms, this is about building datafeed modules as per the Melon protocol, something we know how to do and are very much excited about.

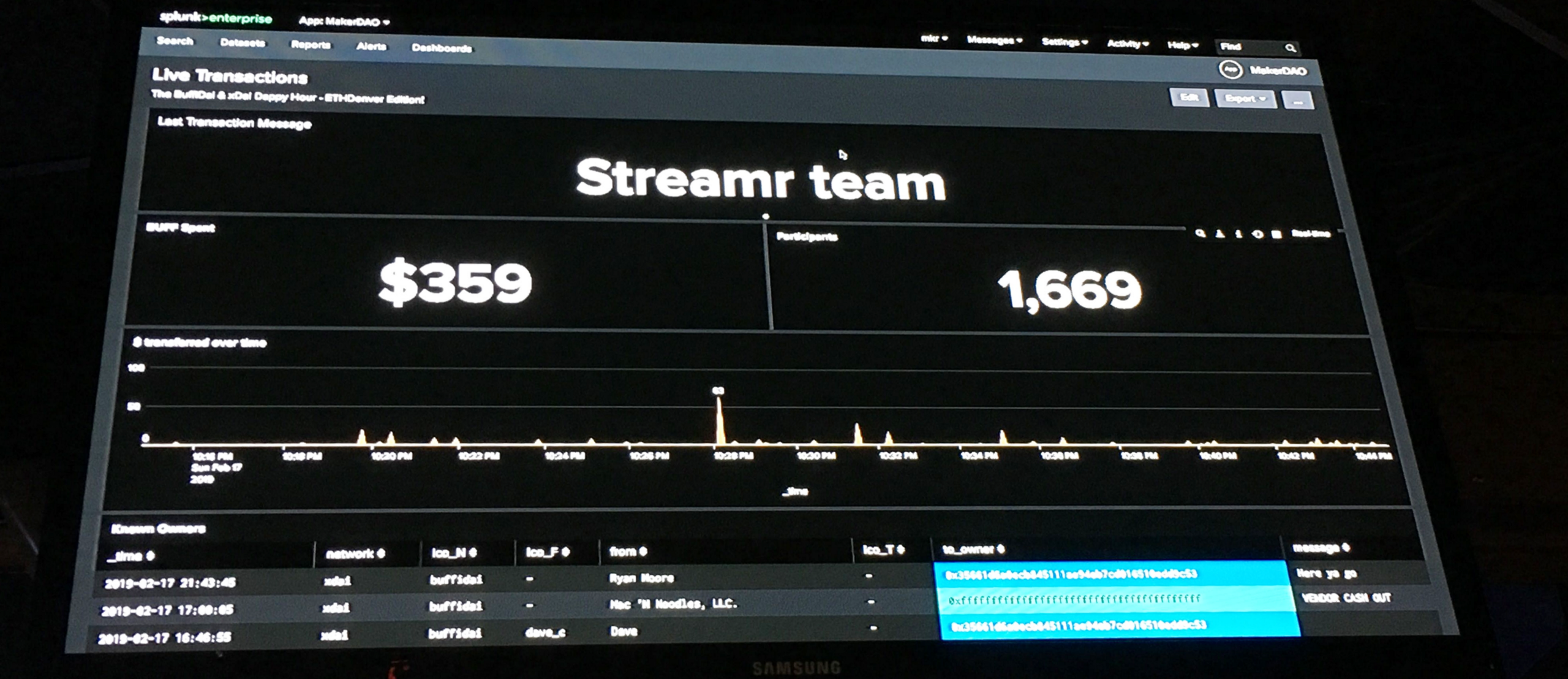

So yes, Streamr can act as a data source for Melon, but Melon can equally well act as a data source for Streamr. An important part of the Streamr roadmap is the marketplace for real-time data, and lots of highly relevant data will be generated by live asset management processes in Melon. Such data includes portfolio holdings, valuations, transactions, and the like. Streamr can be the conduit whereby such data are easily made available to relevant and authorized recipients.

Algorithmic trading

Quantitative investing based on computerized trading algorithms is an increasingly popular and successful way to put money to work. Hedge funds such as Citadel, Millennium, AQR, Renaissance Technologies, D.E. Shaw, Two Sigma, AHL, Winton, and many others have a long and enviable track record. And quantitative investing is by no means limited to CTAs and hedge funds. Many of the world’s largest asset managers and financial institutions offer quantitative funds and investment products.

Systematic strategies can be used for many purposes, ranging from long-term, rule-based investing to medium or high-frequency strategies which aim to exploit potential inefficiencies or which take advantage of various risk premia. Quantitative investment is a fascinating field with lots of clever people working on great ideas. Many of the strategies and certainly much of the actual code is, of course, proprietary. But if you want to get a flavour of what works, you could do much worse than start with Antti Ilmanen’s highly rated and very readable treatise on Expected Returns.

This is also a space where innovation is making waves. Disruptive platforms such as Quantopian and QuantConnect allow anyone to try their hand at quantitative investing. Numerai and Quantiacs offer outlets for data scientists who want to apply their skills to real-life investment decisions. For new entrants to the world of computer-driven investing, barriers are lower than ever before.

There is of course no reason to assume that investment decisions will always be done by human beings. As it is, many quantitative strategies have been automated and computerized for more than two decades by now. This is often a necessity, given that human traders are simply too slow to find and act upon many fleeting opportunities.

Computerized trading systems — or robot traders for want of a better word — have a somewhat sinister reputation by association with things like dark pools and flash crashes. But there is no reason why robot traders — or swarms of decentralized robot traders — cannot make long-term investment decisions. And there is a very real possibility that our dedicated trading robots with clever software will make much better decisions than we humans with our all-too-emotional wetware.

All change, please

If you have the investment ideas and the market knowledge, it is easy enough to get started. You need some amount of capital, the ability to code in Python, Matlab or the like, an account with a financial broker, and a platform where you can try and out and simulate your ideas, and even build your very own trading robot. But what about the next step? Even if you can accumulate a respectable live track record, how do you scale up and set up a professional trading operation?

The unfortunate reality is that setting up a fund used to be costly and time-consuming. Typically more than half the cost of running an asset management operation is spent on support functions, including fund administration, portfolio valuation, risk management, performance and management fee calculations, compliance monitoring, and reporting.

Unless you already started rich, you would need to raise tens of millions of outside capital to cover the costs of institutional money management. Enter Melon, and things are suddenly different. The time, effort, and cost can be cut by orders of magnitude. For aspiring money managers, this is exciting indeed!

Automating the asset management process

Where does all this lead to? Would it not be great if any asset manager could easily and reliably automate their investment process? We believe that Melon provides the right elements for making such a vision a reality.

One highly useful property of the Melon protocol is its modular design. This makes it amenable for use through a web portal with an advanced user interface. Imagine building a new fund in a drag-and-drop fashion: Pick the relevant valuation and risk management modules from professional and reputable third parties, choose data modules for financial market data and other inputs, adjust parameters, run backtests and simulations, build the whole process visually in a low-code front-end.

There is, of course, one such web portal already, i.e. the Melon portal. Our good friends at Melonport tell us that the portal is open and free for anyone for customization and white labelling. The Melon portal is a great starting point, and you can add any kind of functionality on top: An off-chain processing engine, integrations to data providers, know-your-customer (KYC) processes, backtesting capabilities, algorithmic trading tools — the possibilities are endless. And as it happens, Streamr is very well placed to provide such additional functionality, given our existing tools, the technology stack, and the skills.

There are huge potential gains here in terms of lower cost, lower barriers to entry, higher efficiency, transparency, reliability, and trust. Melonport is embarking on an exciting journey, we wish them the best of luck, and will contribute to their effort where we can.

In a future blog post, we will go into specifics and implement a Streamr DataFeed module using the Melon protocol. Who knows, we might even get carried away and show how to create an automated robot trading strategy for systematically investing in popular cryptocurrencies. Watch this space, and in the meanwhile, Aux Barricades Citoyens!